[ad_1]

From supermarkets to department stores, private labels or store brands are becoming more important to both profitability and customer retention.

According to a recent research report from Oracle, private label dollar growth in Australia outpaces branded products by nearly 2x.

Private labels currently account for 18% of the Australian market, with significant opportunity for further growth. Australia is still way behind the global average and especially Europe. In the UK, private brands command almost half of the market (47%).

Retailers can realise 25-30% higher margins on private labels and customers are customers can’t get enough. Half of Aussie shoppers say private brands are most important in their shopping experience. Only a third of Australian shoppers now feel brand names are important, with 3 in every 5 (59%) agreeing that private labels are of equal quality.

As the demand and opportunity for private brands has increased, so has the need for a more considered brand approach. While you may find packaging that still looks ‘basic’ or ‘cheap’, most retailers are creating a range of products that are tailored to different consumer segments and even higher price points. In many cases, the packaging leverages category trends and codes, with some even hard to distinguish from the leading and premium brands.

With so much at stake, retailers are continuing to invest in more sophisticated brand architecture strategies to protect and grow their main brand.

From strong and consistent masterbrands, through to purpose led brands and a true house of brands portfolio, we’ve collated some of the best examples of brand architecture approaches retailers are taking in the UK, USA and in Australia.

The White Company – The power of One brand

The White Company is a good example of a masterbrand approach that focuses everything on building and delivering the core brand promise and experience.

The approach uses the same brandmark, with a restricted monochrome visual language that allows range name and typography variations to define the products.

The brand relies on high quality production and packaging to underpin the premium, minimalist look and feel.

Subtle variation of the brand has been allowed for niche product ranges such as Loch (for men).

Good & Gather – United by a common promise

Target (USA) recently introduced Good & Gather with a range of products all focused on a promise of ‘eat well every day’.

There is a consistent use of the icon with varied brandmark lockups with Signature, Plant based and Organic ranges that use the same identity but vary the shared visual language to keep everything in the family.

M&S – A consistent brand stamp with tailored ‘on trend’ range design

Marks & Spencers (M&S) has been a leader in the development of premium private label branding. Across their wide selection of ranges, there is always a consistent but minimal M&S brand stamp or endorsement.

This approach allows more of a category-specific and creative visual language design to shrug off traditional ‘own brand’ baggage.

The M&S approach also allows for more dramatic visual variance that can align to category trends whilst keeping a consistent quality stamp across all products and a halo effect for the broader brand.

Coles – A diverse and flexible strategy that covers every base

Over the past 10-15 years Coles has made their private strategy core to their growth strategy. Currently, about a third of their products are part of their private stable. Their aim is for private labels to represent 40% of all sales.

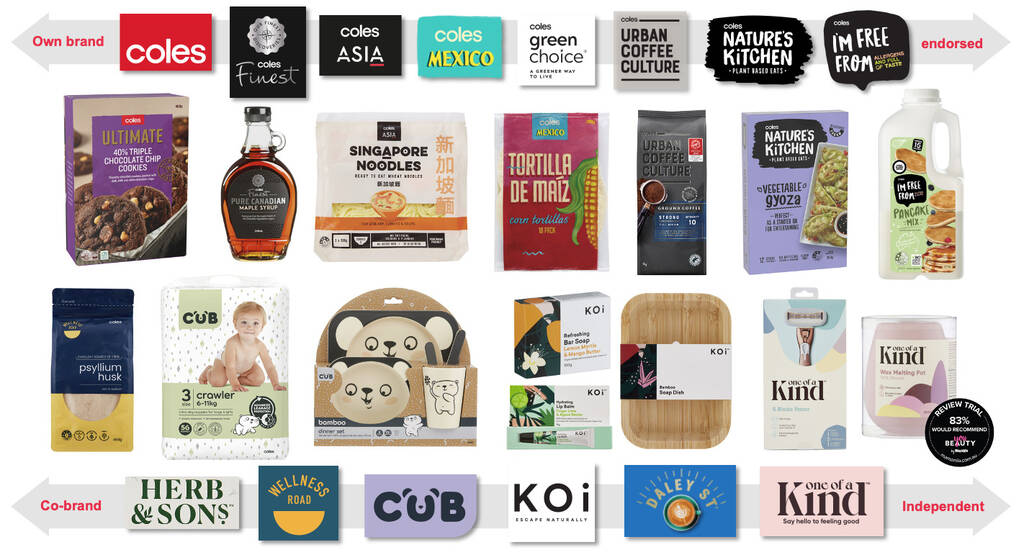

Coles has dozens of in-house ranges, sub-brands and pseudo-independent brands. Some are clearly a Coles brand, others are subtly endorsed or linked to Coles with some deliberately designed to not look like a private label.

Ranges include Organics, ASIA, Graze, Kitchen etc. Sub-brands or endorsed brands like CUB, I’M FREE FROM, NATURE’S KITCHEN etc. Or Pseudo-Indi brands like KOi, Herb & Sons, Ion, One of a Kind etc.

Visual language in each is controlled forming strong in-store recognition and product connection while the house brand is subtle or hidden.

Jenny Craig – From a grudge purchase to a brand asset

Finally, Jenny Craig, a brand that Truly Deeply has been working for nearly a decade.

Jenny isn’t a traditional retail brand but the Jenny food and the private label has always been an essential part of the weight-loss programme.

Jenny’s food and packaging was negatively impacting the programme’s ability to attract and retain clients. The new range of food and packaging that brought to life a new foodie ethos. This played a vital role in shifting old perceptions and lifting the brand experience for its customers.

The new approach to packaging makes food appetising and brings tips from the Jenny consultant onto the pack.

In line with their new intermittent fasting program, Max Up, a new range of Recharge Bars was created. The bars and box have since inspired a new range of Jenny packaging that highlights the on-off, day-night cyclical nature of fasting. This has also been applied to their vitamin and supplements. The simpler design includes matt, textures and foil finishes to achieve a premium feel.

Read more about our work for Jenny Craig here.

If you’re looking for some help to rethink or develop your brand architecture strategy and design, we’d be happy to help. Please contact us.

Michael Hughes

Michael is Managing Partner and Strategy Director at Truly Deeply. His deep expertise is in unlocking the strategic power of your brand to create a differentiated, compelling and authentic brand proposition that will engage all your audiences and drive your business growth. Michael has extensive experience working with leading Australian and International organisations across just about every sector.

Source link